By Marie Ragias

Underwriting Counsel

Title First Agency

Trusts are becoming ever more popular in estate planning, and it is important for you as an agent

All buyer and seller trust entities will need to provide either a Memorandum of Trust or Certification of Trust as evidence of the Trustee’s authority to handle the real property transaction. Ohio Revised Code Section 5301.255 governs Memorandums of Trust, and Ohio Revised Code Section 5810.13 governs Certifications of Trust. Each code section lays out the information that is required to be obtained in either

Why are these documents required?

These documents clarify in the public record that the trustee acting on behalf of the trust had authority to buy, sell, and/or mortgage the subject property.

A selling trust may already have one of record with the county recorder, in which case the seller trustee

A buying trust may not have one of record if this is their first purchase under the trust, in which case, one will need to be prepared to record for purposes of satisfying a lender requirement and for obtaining a policy

of title insurance.

Depending on the circumstances of your client’s transaction, they may also need to provide an Affidavit of Successor Trustee. If the trustee that originally took the title as a representative for the trust is now deceased or has otherwise been removed as trustee, Title First will need to have an Affidavit of Successor Trustee prepared, which will name the new trustee who now has authority to act on behalf of the trust. Typically, the Successor Trustee is named in the original trust agreement.

If your client is uncomfortable providing information from the Trust or is hesitant, then we can help alleviate matters by pinpointing what we need from the original trust document. Your client can have the above documents prepared by their own private attorney or Title First can facilitate preparation of these documents by referring to a private attorney outside of Title First. By providing these documents early on, the closing process will be more efficient.

Scratching your head with questions regarding what documents are required? Good news! – Title First has NINE attorneys on staff who are more than happy to answer any questions about what will be required of your buyer or seller trust.

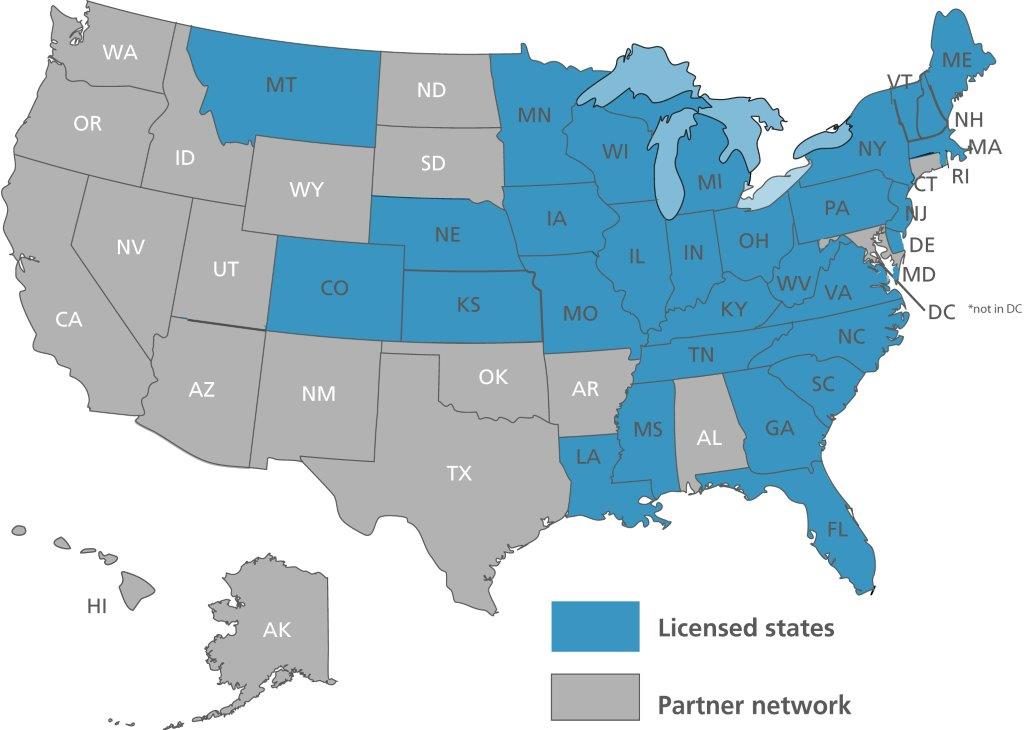

See Our National Coverage Map

See Our National Coverage Map