1. Prepare your home for maximum earnings There are simple steps you can take to maximize your home’s appeal.

2. Enlist the help of a Realtor® to market and sell your home When selling your home, a Realtor® can provide expertise in valuing and advertising your home, qualifying and screening potential buyers, and negotiating contracts. If you are not able to enlist help from a Realtor®, Title First can provide you with assistance.

3. Negotiate a contract When you receive an offer for the purchase of your home, it must be in writing, generally on a preprinted real estate purchase contract from your local bar association or board of Realtors®. You may modify or alter the offer in any way you, your Realtor®, or your attorney wish. Offers and counter offers are made until the terms of the contract have been fully agreed to by all parties. When assessing offers and making counter-offers to the seller, don’t feel pressured to accept less than the value of your home.

4. Close on the property Before your home is officially sold, you must sign all appropriate documentation at your closing.

The closing will typically be held at a Title First office, the office of your realtor, lender or attorney, or sometimes on-location. Because your home represents one of the most significant investments you will make throughout your life, it is important that you feel comfortable with all the information being presented to you during the closing procedure.

Title First is dedicated to walking you through this important process with care and attention. When it’s time to set up your closing, don’t hesitate to tell your realtor or lender to call Title First, or feel free to give us a call if you’re working by yourself.

Be prepared for these seller’s fees commonly seen at the closing

Fees: Current loan payoff Conveyance fee, Title insurance examination, Title insurance commitment/premium for owner policy

Documentation to provide your Realtor® with: Tax receipts, Utility bills, Mortgage Payment

Information to provide to Title First: Your mortgage company name, address and account number. Any existing title insurance policy.

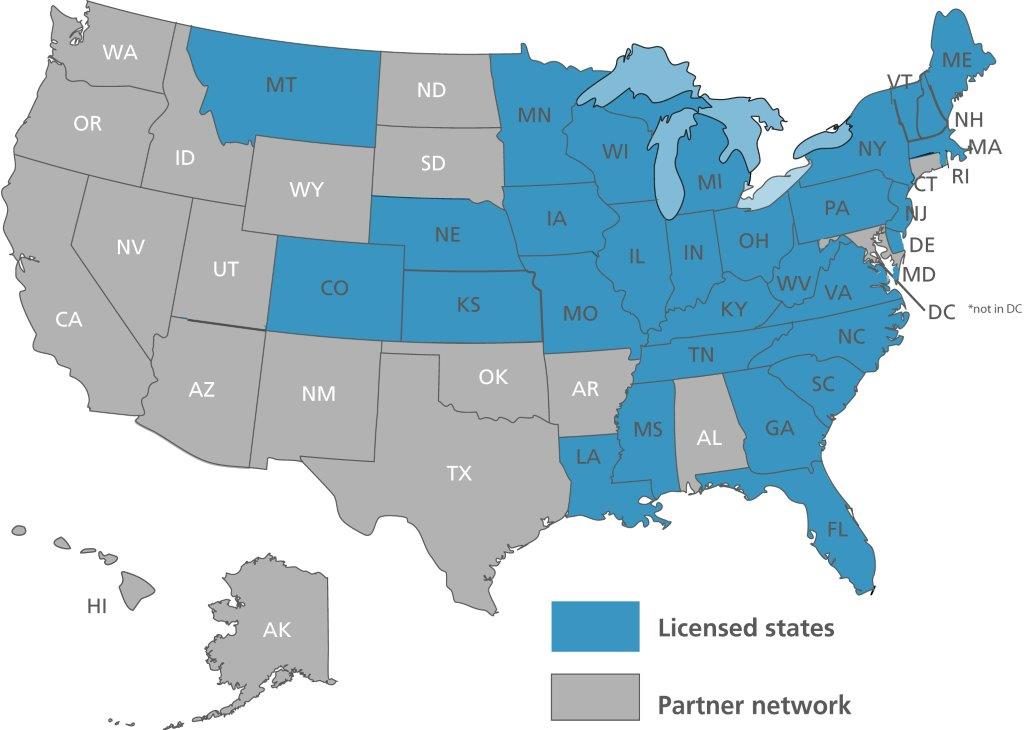

See Our National Coverage Map

See Our National Coverage Map