The kitchen is king. A newly renovated kitchen can help you sell your home for more money and sell your home faster. But, before you take on the work, prospective sellers should talk to the Realtors local to them and find out how they compare to the rest of the market. Find out what their home, their kitchen in this instance needs to have for the buyers out there looking for a new home. Often the kitchen can make or break a home sale. Kitchens can be the deciding factor.

Clean

The cheapest thing to do is to start with an immaculately clean kitchen. Clear counters of clutter and remove any items from the tops of cabinets and the refrigerator. This makes the kitchen appear larger and getting rid of any personal items will help potential buyers focus on seeing their own things in the area.

Paint

Fresh paint is a relatively inexpensive way of changing the entire look of a room. Opt for light, neutral colors. There is an endless amount of primers and paints available now, making it easy to really make a transformation. Sometimes just cleaning and painting is all it takes to make your kitchen look totally transformed!

Cabinets

It might not be in the budget to change out the cabinetry completely, but there are little things that can be done to create a total makeover.

- Replace doorknobs and drawer pulls with classic finishes such as brushed nickel or stainless steel for a brand new look. Hardware stores carry a variety.

- Painting cabinets always make an instant upgrade. Ask a knowledgeable Realtor what color is the most popular. Add a pop of color by simply painting the inside of the cabinets.

Backsplash

Have some fun with this update. Make a bold statement or blend it into the background. If it is outdated, it’s fairly simple to replace it DIY. This is a way to help make a kitchen stand out from the others on the market. Realtors often select subway tile and while white is the most popular, a color can be used to coordinate with the countertops.

Flooring

Refinish wood floors or replace broken ceramic tiles. For scratched, torn, or faded linoleum, it might be time for a complete redo. Most Realtors will confirm that hardwood flooring is the biggest preference closely followed by tile. Consult with a good Realtor on which is the best seller in the neighborhood.

Countertops

A bigger job but can make an incredible difference in the kitchen. If changing the countertops and living in the home for a time before selling it, install what is enjoyable to live with but will also add value. If changing countertops to sell a home, upgrade to the standards of the neighborhood.

Lights

Replace old and outdated light fixtures with pendant lights. Spray paint any brass fixtures. Upgrading lighting fixtures can help improve potential buyers’ first impressions. Buyers all know they will spend most of their time in the kitchen and proper lighting is a good purchase. Proper lighting can make the difference between a dull room and a rich first impression.

Stage

Potential buyers want to envision themselves and their “things” in the kitchen. Again, have a Realtor that will speak the truth of what should be done.

- For eat-in kitchens, use a smaller table and chairs to make the area appear larger. Place a throw rug under the table to define the separate space.

- A few well-placed plants bring life and warmth.

- Add gourmet touches to your now cleared counters such as a bowl of polished fruit, a full bottle of herbed olive oil, or a small wine rack.

- Polish fixtures, replace light bulbs, and dust every corner.

- Remove magnets from the refrigerator to help depersonalize.

- Window treatments should be light or neutral colored.

- Stow cleaning products under the sink.

The Botton Line: First impressions really matter in Real Estate. Within seconds, we all decide whether we like something or not. The house might be in the best neighborhood, but if the first impression isn’t up to par, it will be tough to sell. And, again, the kitchen is still king when selling a home and a “modern, updated kitchen” tops the list every time in surveys.

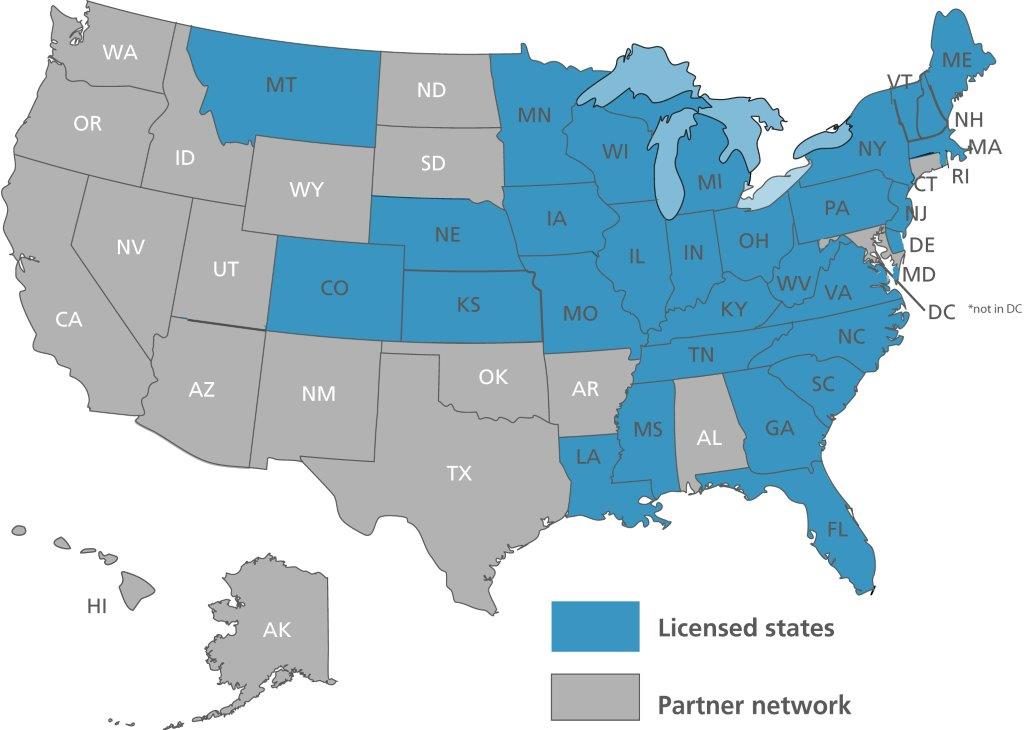

See Our National Coverage Map

See Our National Coverage Map