The American Dream. Owning your own home. Is it your time to have a piece of that dream? Are you ready? Because if you aren’t there can be some big financial consequences. Here are some pros and cons to owning a home:

PRO: Build Equity. Home equity is the difference in the market value of your home and how much you owe. So let’s say you’ve taken the mortgage and the market value of your house went up. You still pay out a fixed mortgage sum, so there is a difference between those two numbers and that difference can be put to good use, that’s your valuable asset.

PRO: Tax Benefits. Owning a home is a huge investment. Even if you’re not pulling your equity loan, there is always a chance to sell your house later for a better price. Today, as a homeowner you’ll also be entitled to tax benefits.

PRO: A Monthly Mortgage Payment Can Be Lower Than Rent. You should understand that it works only for some cities and states, but sometimes the monthly mortgage payment is lower than the rental payment or, at least, equal. This is a pretty good reason to prepare the down payment and take the mortgage.

PRO: Improve Your Home The Way You Want. Owning a home gives you home improvement freedom. There is no landlord who says what you can and cannot do while decorating and improving your house. Renovate your property or completely redesign your bath, you can do whatever you want with your own place. This is something worth paying for.

CON: You’re In That Same Home It Until You Sell It. While you have the freedom to make the home exactly the way you want it, you don’t have the freedom to leave your mortgage. the freedom mentioned above, when you take a mortgage for a house, you’re stuck with this particular place for a long time. When you are renting, it’s as simple as finding a new rental and off you go.

CON: Property Taxes. As a homeowner, there are plenty of tax benefits, but you are also obligated to pay property taxes which is usually collected by the municipal government. The value of the property tax is determined by multiplying the property tax rate by the market value of the particular property. Market changes a lot and it means that municipalities may recalculate the property tax.

CON: Home Repairs and Maintenance. The house is fully yours and it means that all the repairs and the whole maintenance process are on you. It’s always fun to call a landlord and ask him to fix a sink, but now you’re on your own and, of course, you pay for all the materials, work process and spend money on keeping your house well-suited for living in it.

The Bottom Line: For many people, owning a home makes more sense financially and from a lifestyle perspective than renting a home. Owning and renting each has its advantages, but what’s best for you depends on your circumstances. Crunch all the numbers.

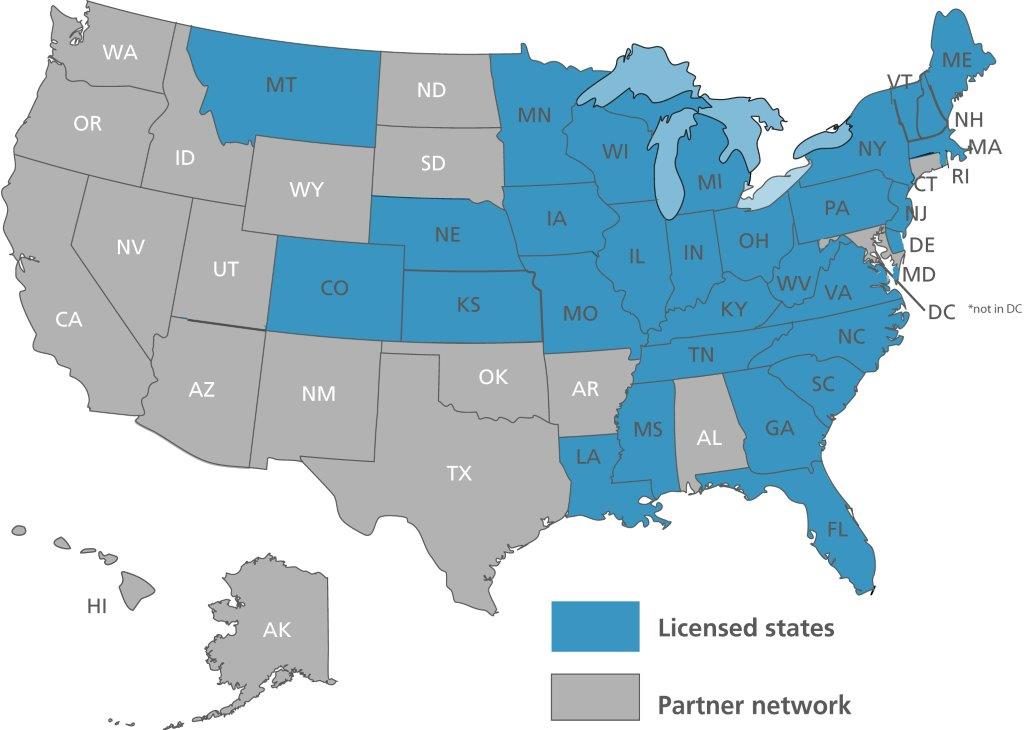

See Our National Coverage Map

See Our National Coverage Map