The possibility of owning a home is exciting, but it’s easy to get swept up in the glamorous and fun aspects of this buying decision. While it can still be a fun process, deciding whether to rent or buy is a difficult personal decision that requires the thoughtful consideration of a variety of factors.

Due to the immense financial investment, long-term commitment, and overall risk associated with buying a home, you’ll need to analyze your financial situation, the current housing market, and your goals to determine whether renting or buying is right for you. While it can be a substantial risk, especially if you don’t plan carefully, it can also be a highly beneficial investment.

Weighing the general pros and cons and cons is one thing, but when it comes to making the right choice for your lifestyle, it comes down to evaluating the hard facts of your personal situation. To start you off on the right track, there are some important questions to ask yourself to help guide your decision.

Is It the Right Time to Buy?

It’s important to understand where the housing market stands right now so you have a basic understanding of what you’re entering into purchasing property.

Timing is everything when it comes to buying a home. You need to consider whether it’s a buyers’ or sellers’ market, what seasons see the most competition, and how the current state of the economy will affect mortgage rates, the ability to get approved for home loans, and property prices.

As we saw with the Great Recession, we are now experiencing stock market issues and job losses which are impacting the housing market. This is all due to the COVID-19 pandemic, which has halted normal life for most people. Even after things begin to return to normal, the effects the pandemic has had on the economy and individual financial situations is expected to last for quite a while.

According to Whiterock Locators, here are some of the current housing market issues you should be aware of:

- Lending restrictions are becoming more rigid

- Salaries are not increasing at the same rates they used to

- Housing costs are high with an average of over $300,000

With this information in mind, you can determine whether now is the right time to even consider purchasing real estate.

Can You Afford to Buy?

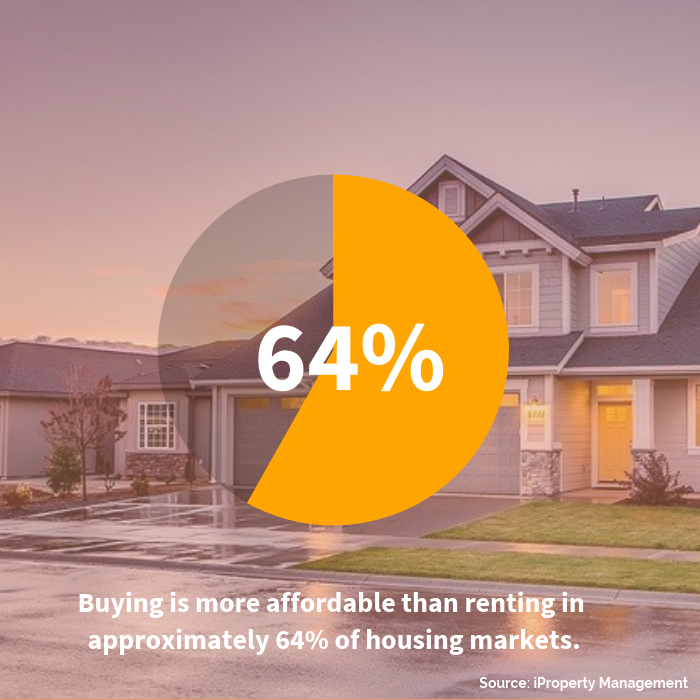

According to iProperty Management, buying is more affordable than renting in about 64% of U.S. housing markets, which is why many people who’ve been content renting are now considering taking the leap into homeownership. However, one of the most important questions you need to ask yourself is, “Can I afford to buy?”.

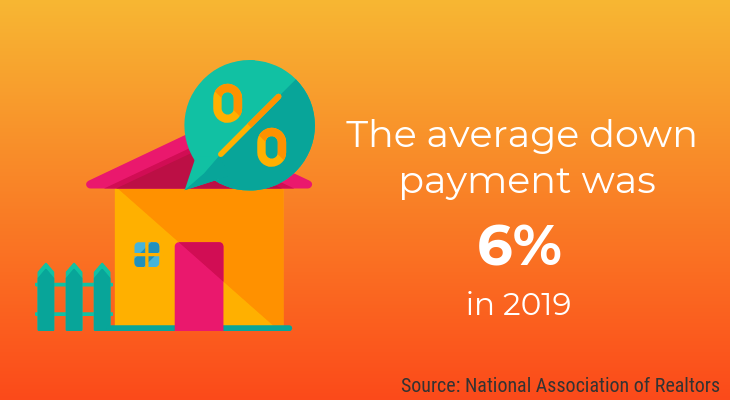

Whether it’s a home, apartment, or condo, purchasing real estate is an investment. First, you have to save for the down payment. While in the past, down payments have traditionally been 20%, that requirement has become much lower with the many new loan options available—especially if you’re a first time buyer.

Down payments are typically much lower nowadays; the average down payment was 6% in 2019, according to the National Association of Realtors. That said, it’s still a lump sum of money (usually upwards of $10,000) that you need to have in-hand at the time of purchase—which is no small feat for many people who have barely surpassed living paycheck-to-paycheck or are now unable to make rent because of COVID-19 layoffs.

Buying a home requires more than just saving up the down payment. You also have to consider the many other costs associated with homeownership, such as:

- Mortgage payments

- Insurance

- Homeowners’ Association fees

- Repairs and maintenance

- Emergencies

Not to mention, many of your bills may be higher if you’re moving from an apartment or condo to a full-size home.

If you’re uncertain about being able to manage any of these costs, and you’re finding places to rent in your budget, you may want to keep renting until you can save up or increase your income.

Is Your Financial Situation Stable?

While you can never be absolutely sure that your job is stable, you should consider certain factors to determine whether your financial situation is reasonably sound. To get a general idea, ask yourself:

- Have you been in the same job for more than a year (at least)?

- Do you plan on staying in the same career or is a change on the horizon?

- Do you have savings to help cover the cost of emergencies?

- Are you able to afford your estimated mortgage payment without making significant changes to your current budget?

If you said yes to all of these questions, then you likely have a stable financial foundation to at least consider buying. However, you should also think about whether any other major changes could affect your stability now, or any time in the near future. For example, is it likely that you’ll need to purchase a new car, go back to school, or welcome a baby into your family? If so, it may be better to hold off and stay in your rental until you’re more certain that your finances won’t be fluctuating.

Are You Planning to Put Down Roots?

If the possibility of moving is in the cards for you, you may want to hold off on purchasing a home. Unless you’re looking to flip the property, buying is typically best if you’re looking to put down roots since it’s a long-term investment. After all, most mortgages are 15 to 30 years.

However, if you live in a highly competitive region where it’s fairly easy to find reliable renters, buying a home that you can turn into a rental property may be a smart investment. Plus, if you decide to move back, you’ll have somewhere to come back to without having to search for a rental.

That said, for most people who think moving somewhere else is a possibility in the near future, or those who plan to travel long-term, it’s probably best to stick with renting for now.

Final Thoughts on Renting vs. Owning

When it comes down to it, only you can decide whether renting vs. owning is right for you. As rental costs continue to increase, for more and more people, it will likely be the latter. However, the answers to these questions will be your guide to whether you are ready to seize the opportunity and start building your own equity, or if you need the flexibility of renting for a while longer while you sort out your finances and life plan. Either way, starting the conversation to consider homeownership is a step in the right direction so you can start planning for the future and buy when you are ready.

See Our National Coverage Map

See Our National Coverage Map