- A fire destroys only the house and improvements. The ground is left. A defective title may take away not the only the house but also the land on which it stands. Title insurance protects you (as specified in the policy) against such loss.

- A deed or mortgage in the chain of title may be a forgery.

- A deed or a mortgage may have been signed by a person under age.

- A deed or a mortgage may have been made by an insane person or one otherwise incompetent.

- A deed or a mortgage may have been made under a power of attorney after its termination and would, therefore, be void.

- A deed or a mortgage may have been made by a person other than the owner, but with the same name as the owner.

- The testator of a will might have had a child born after the execution of the will, a fact that would entitle the child to claim his or her share of the property.

- A deed or mortgage may have been procured by fraud or duress.

- Title transferred by an heir may be subject to a federal estate tax lien.

- An heir or other person presumed dead may appear and recover the property or an interest therein.

- A judgment or levy upon which the title is dependent may be void or voidable on account of some defect in the proceeding.

- Title insurance covers attorneys’ fees and court costs.

- Title insurance helps speed negotiations when you’re ready to sell or obtain a loan.

- By

insuring the title, you can eliminate delays and technicalities when passing your title on to someone else. - Title insurance reimburses you for the

amount of your covered losses. - A deed or mortgage may be voidable because it was signed while the grantor was in bankruptcy.

- Each title insurance policy we write is paid up, in full, by the first premium for as long as you or your heirs own the property.

- There may be a defect in the recording of a document upon which your title is dependent.

- Claims constantly arise due to marital status and validity of divorces. Only title insurance protects against claims made by non-existent or divorced “wives” or “husbands.”

- Many lawyers, in giving an opinion on a title, protect their clients as well as themselves, by procuring title insurance.

- Over the last 24 years, claims have risen dramatically.

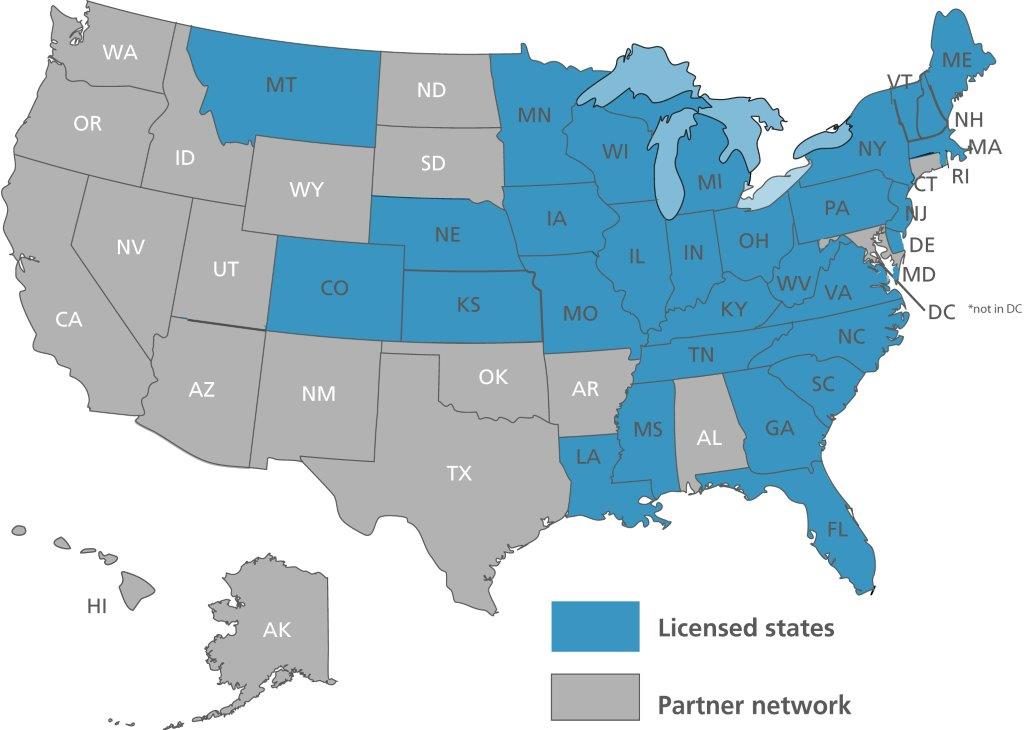

Dedicated to innovation and passionate about service, Title First Agency is your comprehensive, nationwide resource for title and real estate settlement services. Headquartered in Columbus, Ohio, Title First has branch offices throughout the Midwest and a robust virtual partner network throughout the country. Title First got its start in 1956 as an affiliate of a local law firm and has since emerged as one of the largest independent title agencies in the nation.

Proudly servicing Realtors, lenders, builders, developers, law firms, buyers and sellers, Title First is equipped to serve your residential and commercial title and settlement needs. Title First Agency. Your title company.

See Our National Coverage Map

See Our National Coverage Map